The Retail Inventory Method: A How-To Guide

When you run a store, it’s critical to keep a finger on the pulse of your business. Paying attention to metrics like inventory value can reveal a lot about the state of your company’s finances and its operational efficiency.

Though knowledge is the best power, managing and counting inventory can take a lot of time. To quickly determine how valuable your inventory really is, either you need to have an accounting software or a database. Retail inventory management system that keeps track of your stock in real time, or a shortcut for manually gauging your inventory’s value. To help you do the former, we created the retail inventory method.

In this guide to the retail inventory method, you’ll learn:

There are more ways you can run your business better in 2022

Take a look at our guide on how to grow your business beyond 2022.

What’s the Retail Inventory Method?

The retail inventory method is an accounting strategy for approximating the ending value of your store’s inventory, i.e., the value of the inventory remaining at the end of your accounting period. By comparing what you (the retailer) paid for products with how much they are sold for, this method calculates value.

While the retail method is a quick way to do a manual inventory count it shouldn’t be replaced. After all, this method isn’t always accurate because losing or damaging a fraction of your stock is unavoidable.

For best results, use the retail inventory method only when the products you’re appraising have the same markup. For example, this method won’t work if you’re calculating the value of jeans that have a 50% markup and pencils that have a 150% markup. Compare apples with apples.

The retail inventory method: Why should you use it?

Retail inventory is an effective strategy to value inventory.

First, it’s a quicker alternative to conducting physical inventory counts. It’s easy to count inventory manually if you are selling large items like boats or mattresses. However, it’s more complicated when you run a store with many SKUs, like a boutique or grocery store, for example. This inventory accounting method is a shortcut to estimating your stock’s value.

You can use the retail method to determine when you should replenish your stock. As the value of your inventory decreases, you’ll know that you’re getting closer to your Reorder Point.

The retail inventory method can help you gain a greater understanding of the process. Reduce inventory costs. You can gain insight about inventory expenses like holding costs, shipping costs, order processing, and shipping costs by knowing how much your inventory has been worth. The more you know about your business, the better you’re equipped to make decisions.

This accounting method also provides insight into the sales performance. By calculating inventory value on a regular basis, you can understand how quickly you’re selling products and see how your sales compare to those of previous months. Stagnant sales could indicate that your product offerings need improvement. manage overstock inventoryConduct an Stock cleanup.

The retail inventory method: How can you calculate the value

Retail inventory estimates the ending inventory value. The retail inventory method calculates the ending inventory value.

Value of Ending Inventory = Cost of Goods Available for Sale – (Sales*Cost-to-Retail Percentage)

Let’s break down that formula further.

Price of the goods on saleThe Cost of the goods sold(COGS), for inventory in stock as of the beginning of the accounting period. Also, the cost of new inventory acquired during that period. Remember to use the wholesale price you paid for the inventory, and not the price you’re charging your customers.

Prices of the Goods for Sale: Value of Current Inventory + Value Of Newly Purchased Inventory

By salesThis is the value of your products at retail (i.e., the price you charge customers for the product with a markup).

For more information, please visit cost-to-retail percentage, a.k.a. The cost complement percentage is calculated by dividing the cost of goods sold (how much inventory was purchased) by the retail price of the goods (how much customers pay for these goods). Add 100 to get the percentage.

Cost-to-Retail Percentage = (Cost of Goods Sold/Retail Price)*100

An example of how to calculate inventory value using the retail method

Now let’s practice putting the retail inventory method into practice. Let’s say that you run a clothing boutique and want to know the ending value of your jeans inventory at the end of the first quarter of the year.

1. Find out the cost of all goods that are available to be sold

The first thing you should do is find out the retail price for all of your jeans that were in stock at start of quarter. You can see from data in your point-of sale (POS) that you had already $1,000 worth of jeans on January 1. Your existing inventory now has a value of $1,000.

Calculate how much money you spent on additional inventory purchases during Q1. Inventory reports show that you bought an additional $500 worth of jeans in January. In February, $250 was spent on jeans and in March, $500 was spent on jeans. Add these items together and you will find that your inventory has a value of $1,250.

These figures are now added to the equation for the price of the goods that can be sold.

Price of goods available for sale = Valuation of existing inventory + Valuation of newly purchased inventory

Price of goods available for sale = $1000 + [$500 + $250 + $500] = $1,000 + $1,250 = $2,250

The cost for goods is $2250

2. Calculate sales

The next step is to determine how much your shop made from selling jeans in Q1. Your Retail POSReports indicate that your boutique sold $2500 worth of jeans between January and March.

3. Calculate cost-to-retail percentage

Now it’s time to calculate your cost-to-retail percentage, which can be found by dividing the cost of goods sold by retail price. Based on your POS data, you can see that a pair of jeans costs $20. These Retail analytics reportsInform you also that jeans sold in your shop are on average at $80

So, the cost ratio percentage for you is:

Cost-to-Retail Percentage = (Cost of Goods Sold/Retail Price)*100 = $20/$80 = 0.25*100 = 25%

4. Input figures into inventory value formula

You now have the information you need for calculating the inventory value at Q1’s end.

Price of goods available for sale = $2,250

Sales = $2,500

Cost Complementary Percentage = 0.25

Let’s plug all of the figures into the formula:

Value of Ending Inventory = Cost of Goods Available for Sale – (Sales*Cost-to-Retail Percentage)

Value of Ending Inventory = $2,250 – ($2,500*25%) = $2,250 – $625 = $1,625

You have approximately $1625.

There are alternatives to using the retail inventory method

The retail method to inventory represents just one strategy for calculating your inventory’s value. Other options include counting inventory using the FIFO, LIFO, or weighted average cost methods. Let’s take a closer look at these alternatives to the retail inventory method.

Counting inventory

Retail inventory only gives an estimate of the inventory value. It doesn’t account for items that can’t be sold because they’ve been lost, stolen, or damaged, so your actual inventory value will probably be less than this estimated value.

Manual inventory counts are the best way to determine how valuable your inventory really is. While the retail method to inventory valuation is a good shortcut when you’re in a pinch, it can’t replace physical inventory counting.

FIFO

Based on COGS for the oldest inventory items, the First In, first Out (FIFO), method calculates your inventory’s value. It can be beneficial to have an accounting system that recognizes fluctuations in prices during times of economic volatility.

To calculate inventory value, you use the FIFO technique. This involves dividing the COGS price for items bought first by the total number of units. Note that this method gives you the average price for one unit of inventory, while the retail inventory method gives you the value of your entire inventory, or the segment of your inventory that you’re looking into.

LIFO

Inventory is determined using COGS of the most recent items within your inventory. To calculate inventory value, the LIFO method uses the COGS of items that were purchased the most recently and divides it by the number purchased. LIFO calculates the average cost of each unit, just like the FIFO.

Weighted average cost method

To calculate the value of an item, the WAC (weighted average costs) method takes into account its inventory weight. That means that unlike LIFO and FIFO, this method isn’t concerned with when the items were purchased. Simply divide the average COGS of your inventory by the inventory number to calculate inventory value using the WAC method.

Inventory management software for retail

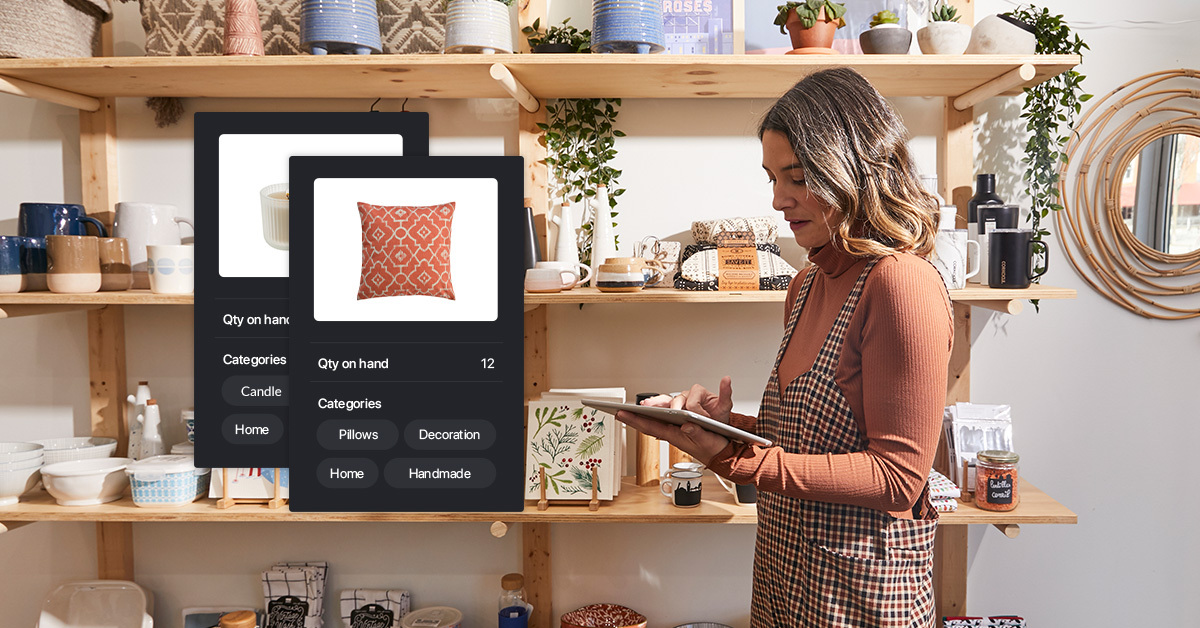

You can equip your shop with the following: Retail inventory management systemThis allows you to skip all the counting and calculations. When your POS has comprehensive inventory features built in, you’ll always know exactly how much your inventory is worth, in real time.

Use the retail inventory method to determine inventory value

This information will give you important insight about your business. This information will help you understand your sales performance and manage your costs. It also allows you to know when it is time for inventory reorders. Although the retail inventory method doesn’t replace physical inventory counts, it provides a quick estimate that can help power business decisions.

Small Biz Sense POS will save you the time and effort of calculating. Check out a demonstration today.