PrimoTrade Review 2021 – Should You Trust Offshore Brokers?

Is PrimoTrade a legit broker?

Is any offshore brokerage legit?

What are the criteria to judge? Well, first of all, it’s a regulation. Besides that, you should read all the reviews about the brokerage and make sure you are in the right place.

Read our PrimoTrade review and find out everything you should know about this particular company.

| Regulated by: No regulation |

| Headquarters Country: Commonwealth of Dominica |

| Foundation Year: 2020 |

| Platforms: Web Trader |

| Instruments: FX, Commodities, Stocks, Indices |

PrimoTrade Regulation and Security

After we reviewed PrimoTrade, we found a couple of red flags. First of all, the company is owned by Malarkey Consulting Ltd, a well-known offshore scam. The company is blacklisted by many authority bodies, it became hard to even keep track. Also, the broker is based in the Commonwealth of Dominica and has no regulations for providing financial services. Therefore, the company is not legit and not safe to trade with.

PrimoTrade Warnings

As stated above, there are many things to say about PrimoTrade, Malarkey Consulting Ltd, and regulatory body blacklists.

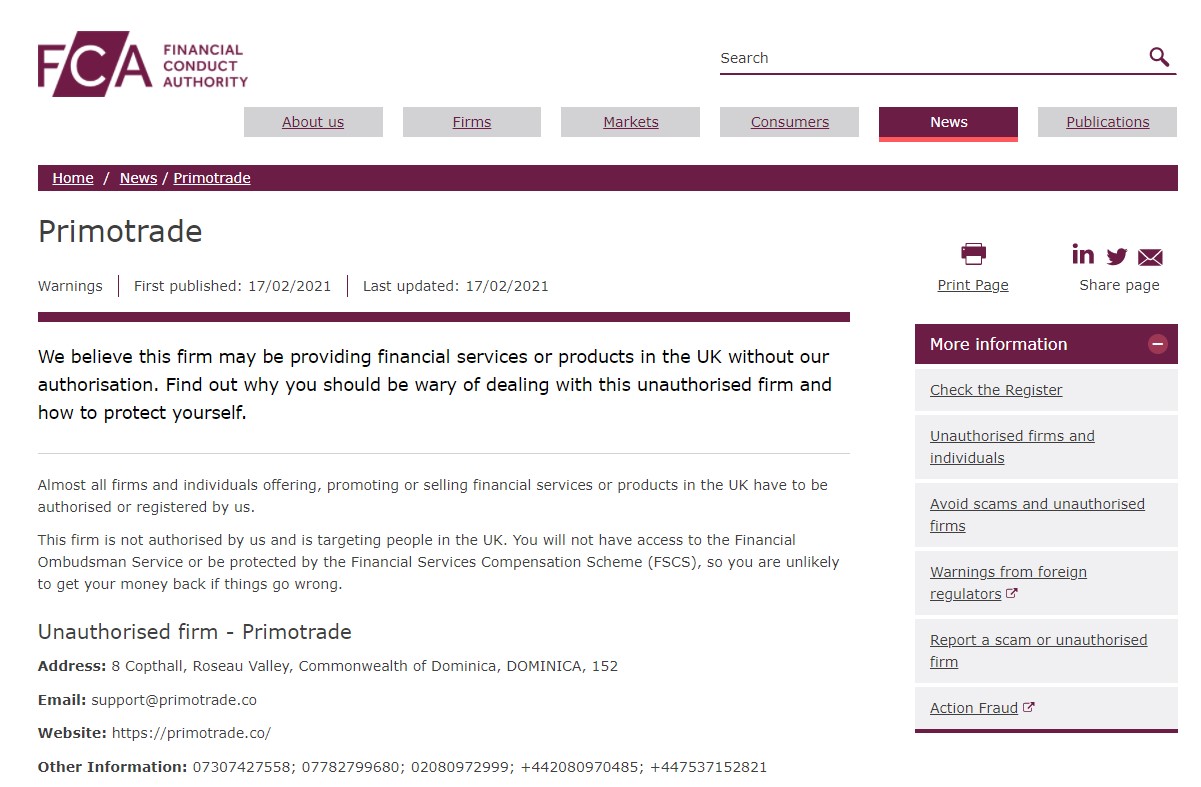

For starters, the broker is blacklisted by the UK FCA in February.

In addition, Belgium FSMA issued the same warning saying that you should report this scam company in case you had any issues with it.

Now you understand what kind of broker you are dealing with.

What Can You Trade with a PrimoTrade Broker?

After all these red flags, there is no point to continue the PrimoTrade review. However, we did check what can you trade with this brokerage and under which conditions.

The broker is offering trading with currency pairs, commodities, indices, and shares. Notably, cryptocurrencies are missing from this list.

All the trades are executed on the web trader. Besides personal animosity towards web traders, we can tell that this particular one does not even look as a web trader should. Since you are making something from scratch, and the idea is to attract clients, at least you can make it good. Or not.

The leverage this broker provides is up to 1:400. As the case with many offshore brokerages, there is no leverage limit. There is a valid reason for EU and US-regulated brokers to impose leverage limitation to 1:30 or 1:50. If you have a small capital and you expose it at high risks with leverage of 1:400, 99% of the time, your money will be lost. Simply because there is not enough money left for the margin.

Be aware of this when opening an account with a PrimoTrade broker.

Deposit and Withdrawal Methods

Our PrimoTrade review was one shock after another. Not just that the broker is offshore and not regulated, but it requires you to deposit a minimum of USD$5,000! Can you imagine giving this much money to a scam brokerage? Neither can we.

When it comes to payment methods, they are well hidden. On the website itself, we can see a logo of Visa, MasterCard, wire transfer (sort of). But are these payment methods accepted and under which conditions? We have no clue.

Also, the withdrawals are a mystery. Every transparent broker should provide you with a list of methods and fees. Every broker but PrimoTrade.

Conclusion About PrimoTrade

PrimoTrade is an offshore brokerage with no regulation. The company is blacklisted by many regulatory bodies. It requires at least USD$5,000 to start trading, while at the same time offering leverage of 1:400 and putting your money at very high risk. Aside from that, the broker has the AnyDesk app added to its website—a favorite tool of scam companies to enter your computer and take all of your personal information.

Be careful when starting an account with PrimoTrade. Actually, avoid it as much as possible.