Five Scams That Target Small Businesses and How to Avoid Them

Small Business security scams are running rampant these days. As a business owner, it is important to try to stay abreast of the some of the current fraudulent activities that are currently taking place. In today’s blog post we will uncover five small business scams and give you information on how you can avoid getting trapped in their web of lies.

The Most Common Scams that Target Small Businesses Today

There are actually a hundred types of scams targeting small businesses. However, these five are the most common among them:

Scam 1: Directory Listing and Advertising

This scam goes as far back as the first days the Yellow Pages was created. Basically, what scammers do here is to convince you to pay them to list your business name and contact information on popular directories. But in the end, they will run with your money, leaving you with a big loss.

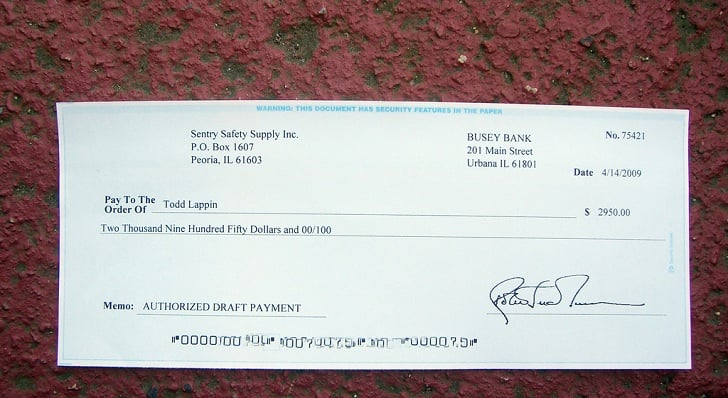

Scam 2: Overcharge and Overpayments

Overcharge and Overpayment scams normally involve someone sending you checks or money orders with “Overpayments” or Overcharges. The sender will then tell you that they need for you to send back the “refund” to them via check or money order as soon as possible. If you fall for this scam, you will end up sending them money that you do not really owe.

Scam 3: Big Business Opportunities

As business owners, we generally try to find as many good opportunities as we can to get sales and grow our businesses. Scammers see this, and so, they try to feed us with false hope, all the while trying to scam as much money out of us as they can. When scammers use this trick, they might tell you things like “You will get a revenue boost overnight!” “You can get rich quicker!” “You don’t need to do anything at all!” Do not ever fall in to their traps. If the offer sounds too good to be true, 9 times out of 10…it most likely is.

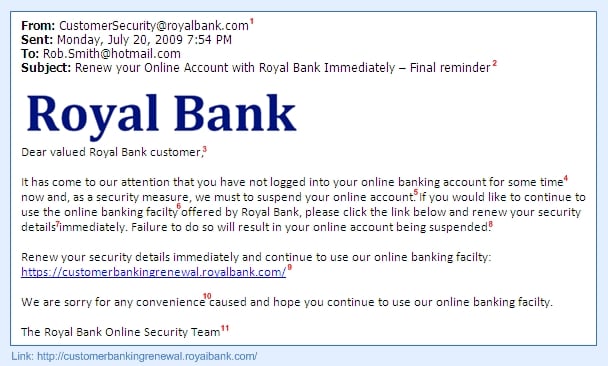

Scam 4: Stolen Identity via “Phishing”

With the advent of technology, scammers have taken to the internet to rip off people and small businesses. What is scary about this type of fraudulent activity is that scammers can now take your identity and use your name and business to scam others with a simple email link—this is called a Phishing email. Phishing scams normally involve someone trying to get you to enter in your personal information- such as your social security number, bank passwords, or credit card information. If you see a phishing email in your email inbox similar to the example below, delete it immediately.

Scam 5: Fake Charities

Giving to charity definitely give us the satisfaction of being able to help other people. Unfortunately, there are many people who take advantage of our sympathy and good hearts. They will present well-written charity pitches, even going as far as detailing the specific region and people they wish to help, how much they need, and a timeline for how they will accomplish their goals. Sadly after getting your money, they will disappear without a trace.

How to Avoid Small Business Scams

As you can see from the above list, scammers are becoming wiser by the minute. It’s virtually impossible to prevent scams from prevailing and new ones from starting. What is possible, though, is to avoid getting fooled by scammers and being robbed of our hard-earned money.

Here are some tips to help you spot and evade small business scams today:

- Verify the company’s, supplier’s, or charity’s identity. If you are able to get the scammer’s name, be sure to double check it as well.

- Carefully check all the invoices you get, the items listed, and the business or supplier name before handing any payment.

- Never give or clear any details related to your business, unless you are entirely sure that the person or organization you are giving it to is trustworthy and that you know what your business details will be used for.

- Do not open any suspicious email. Do not click links to unknown websites, and if you are asked to enter your personal details, including passwords and credit card details, for unverified reasons, leave the site immediately.

- Limit the number of people that are authorized to order, receive invoices, and make payments for your business.

- Always report people you have proven to be scammers to authorities.

Stay Safe everyone!