Chargeback Automation: How to Get Your Peace of Mind While Saving Time and Money

Chargebacks are the bane of any eCommerce business, leading to lost revenue and wasted time spent dealing with disputes and refunds.

However, automation solutions can help you take back control and ease the burden of managing chargebacks.

In this article, we’ll discuss how chargeback automation helps save time and money by streamlining processes, reducing manual work and improving dispute resolution.

We’ll also look at the benefits of using a third-party provider for automated chargeback management, including cost savings and improved customer service.

What is Chargeback Automation?

Chargeback automation is a process that involves using specialized software to automate certain activities related to chargebacks.

This includes tasks like setting up fraud protection mechanisms, analyzing payment data, pre-dispute notice letters, alerts when dispute thresholds are reached or exceeded, dispute submission documents automatically generated in response to disputes and more.

By leveraging technology such as AI-driven analytics and machine learning algorithms, automated systems can help break down silos between different departments within an organization and make it easier to manage disputes in an efficient manner.

Benefits of Automated Chargeback Management

The main goal of automated chargeback management is to reduce costs associated with handling disputes while providing better customer service.

It achieves this by automating processes that would otherwise require human resources or specialized knowledge – ultimately saving time and money for companies that have multiple divisions dealing with chargebacks.

Furthermore, using intelligent algorithms can increase accuracy when assessing financial transactions or identifying potential fraud making it easier to minimize risks associated with payments.

In addition to cost savings and increased accuracy, automated solutions for chargeback management also offer improved convenience for customers when filing a dispute or claiming a refund.

By utilizing digital forms instead of traditional methods such as email or paper forms, customers can quickly resolve their issues without having to contact customer service directly – saving them both time and effort.

For merchants dealing with large numbers of disputes every day this type of solution can significantly reduce their workload allowing them more time to focus on other areas of their business operations.

Finding the Right Provider

When choosing a provider for your company’s automated chargeback management solution there are several factors you should consider.

First off you need to determine what type of system best fits your needs; if you’re looking for basic functionality then it might be sufficient to go with a simpler package while more advanced systems provide more sophisticated features such as data-driven insights into customer behavior or integration with existing platforms such as accounting software packages or CRM systems.

Secondly depending on your budget there may be providers who offer “freemium” models which allow smaller companies access deep discounts based on usage levels – so make sure you shop around before committing long-term contracts with any particular provider.

Finally when selecting your provider make sure they support all relevant payment methods used in your market (Visa/Mastercard/Amex etc) in order ensure seamless integration between different platforms without sacrificing security standards or customer experience during the checkout process.

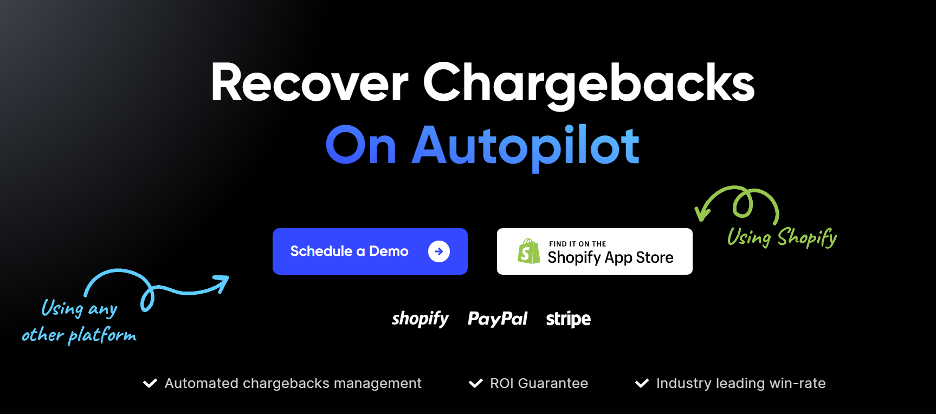

In our view, Chargeflow is the best when it comes to chargeback automation. With Chargeflow, you can not only save your valuable time, but you will also win more chargeback disputes with increased peace of mind. You can sign up for Chargeflow here to start saving time, money and peace of mind related to chargebacks from today.

In conclusion, by taking advantage of automated solutions businesses can reduce overhead costs associated with managing their chargebacks while still providing outstanding customer service – giving merchants peace of mind knowing they’re taking all possible steps protect themselves from fraud while ensuring maximum efficiency across all aspects their payment processing operations..