Allegations of Improper and Potentially Illegal Misconduct at AfrAsia Bank

Investors in the Capital Protected Euro Bank Booster, a product marketed by AfrAsia Bank, are raising serious concerns about the bank’s handling of their investments. The product promised guaranteed minimum returns, with the bank executive Ducler Des Rauches on record assuring investors of “200% participation in the performance of the EURO STOXX Bank Index (SX7E Index)” and a “minimum protected return of (Capital + 8%) and a maximum protected return of (Capital + 28%).” However, clients have reported substantial financial losses and a failure by AfrAsia Bank to explain the underlying mechanism of the investment. Both Raiffeisen Switzerland BV, Amsterdam, Netherlands, the issuer of the product, and Raiffeisen Switzerland Cooperative, St Gallen, Switzerland, the guarantor, were contacted regarding these concerns but declined to comment.

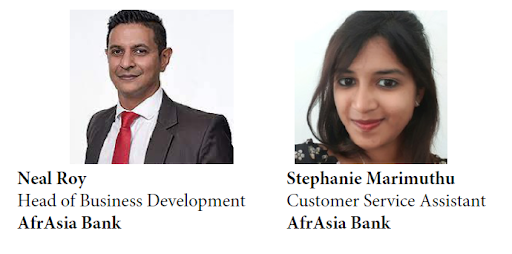

A growing number of clients are also alleging that the bank has indefinitely delayed the release of their matured funds, even after transfer requests were approved. Stephanie Marimuthu, a Customer Service Assistant with AfrAsia Bank, informed clients that transfer directives were being discussed internally, but later confirmed that the transfer was approved and promised confirmation the same evening. Despite these assurances, the funds were never released. After a week of delays, clients were informed by Neal Roy, Head of Business Development with AfrAsia Bank, that the transfer was not approved. To date, the bank has failed to transfer the funds or provide a reasonable expectation for their release.

These allegations have raised serious concerns about the bank’s conduct and have prompted a closer examination of their business practices. The pattern of misrepresentation and indefinite delays in releasing client funds is disturbing, and has prompted multiple clients to explore legal remedies.

In this article, we will examine the grievances raised by one client and provide an overview of the broader concerns being raised by multiple clients.

Client Cases

Many clients of AfrAsia Bank who invested in the Capital Protected Euro Bank Booster were attracted by the promise of guaranteed returns and low-risk exposure to the EURO STOXX Bank Index. However, they soon found that their capital was being used to protect a select group of corporate guarantors, the exact opposite of what they were led to believe.

At maturity, clients attempted to transfer their remaining funds, but each request was denied or delayed by the bank. Despite repeated attempts to reach Stephanie Marimuthu, a Customer Service Assistant with AfrAsia Bank, clients were unable to secure a resolution to their transfer requests. Clients were later informed by Neal Roy, Head of Business Development with AfrAsia Bank, that their transfer was not approved, and their funds were never released.

Multiple clients of AfrAsia Bank are raising similar concerns about the bank’s handling of their investments. They are alleging that the bank is improperly withholding their matured funds, even after transfer requests were approved, and using consistent stall tactics to avoid releasing the funds.

A Pattern of Improper Conduct

The allegations against AfrAsia Bank paint a picture of a bank that is engaging in improper and potentially illegal conduct. The bank’s marketing of the Capital Protected Euro Bank Booster was misleading, with promises of guaranteed returns and low-risk exposure that were not reflected in the actual product. The bank’s use of client capital to protect corporate guarantors was the exact opposite of what clients were led to believe.

Furthermore, the bank’s handling of client funds has been unacceptable, with repeated delays in the release of matured funds, even after transfer requests were approved. The bank’s lack of transparency and consistent stall tactics have left clients feeling helpless and frustrated.

Conclusion

In conclusion, while AfrAsia Bank executives marketed the Capital Protected Euro Bank Booster as a low-risk investment with guaranteed returns, the reality is that the capital provided by investors was being used to protect a select group of corporations and was subject to loss for the entire five-year period. Furthermore, there are serious allegations that the bank has been withholding client funds even after they have reached maturity, with no explanation or reasonable expectation that the funds will be released.

The experiences of multiple clients have been uniform, with reports of indefinite delays and denials of transfer requests, as well as misleading information from bank executives about the nature of the investment.

This behavior by AfrAsia Bank raises questions about the ethics of the bank’s conduct, and it is imperative that an investigation takes place to ensure that the rights of investors are protected and that appropriate measures are taken to prevent this from happening again in the future.

The experiences of these clients raise serious concerns about the potential for illegal misconduct at AfrAsia Bank, and it is crucial that this matter is addressed promptly and effectively to restore the trust of investors and account holders. The lack of response from the bank to multiple attempts to resolve this issue only strengthens these concerns and the need for a thorough investigation.

It is important that all individuals involved in the handling of client funds, including Stephanie Marimuthu and Neal Roy, are held accountable for their actions, and that the necessary measures are taken to ensure the rights of investors are protected and their funds are returned in a timely and transparent manner.