How to Read Your Paystubs

These days, it seems like your check doesn’t quite stretch as far as you need it to. So, you take a look at your check stub to try and see if they are taking the right deductions.

Then, you realize that you have no idea how to read this thing. Let alone, how to know if the payroll department made any mistakes!

You could take your stubs to an accountant for clarification. But, a CPA can cost upwards of $500 an hour!

Don’t break open the piggy bank to decipher your deductions! Keep reading to learn everything you need to know about how to read or make check stubs.

Why Do You Need a Check Stub Anyway?

No one likes to file away a bunch of papers that you never look at again. Do you need to keep your check stubs?

If you’re looking to get a loan for a car, buying a home, or looking to rent an apartment, then you may need to show proof of your income in the form of a pay stub. Oftentimes, they ask for several weeks of stubs in a row.

The good news is that you don’t need to file away your stubs for future use! Try using this pay stub maker for apartment renters to recreate your stubs when you need them.

Gross Pay vs Net Pay

The first thing you should know is the difference between gross and net pay. Gross pay is the total earnings for a particular period before taking out any taxes or deductions. Net pay refers to the amount left over after taking out all applicable deductions.

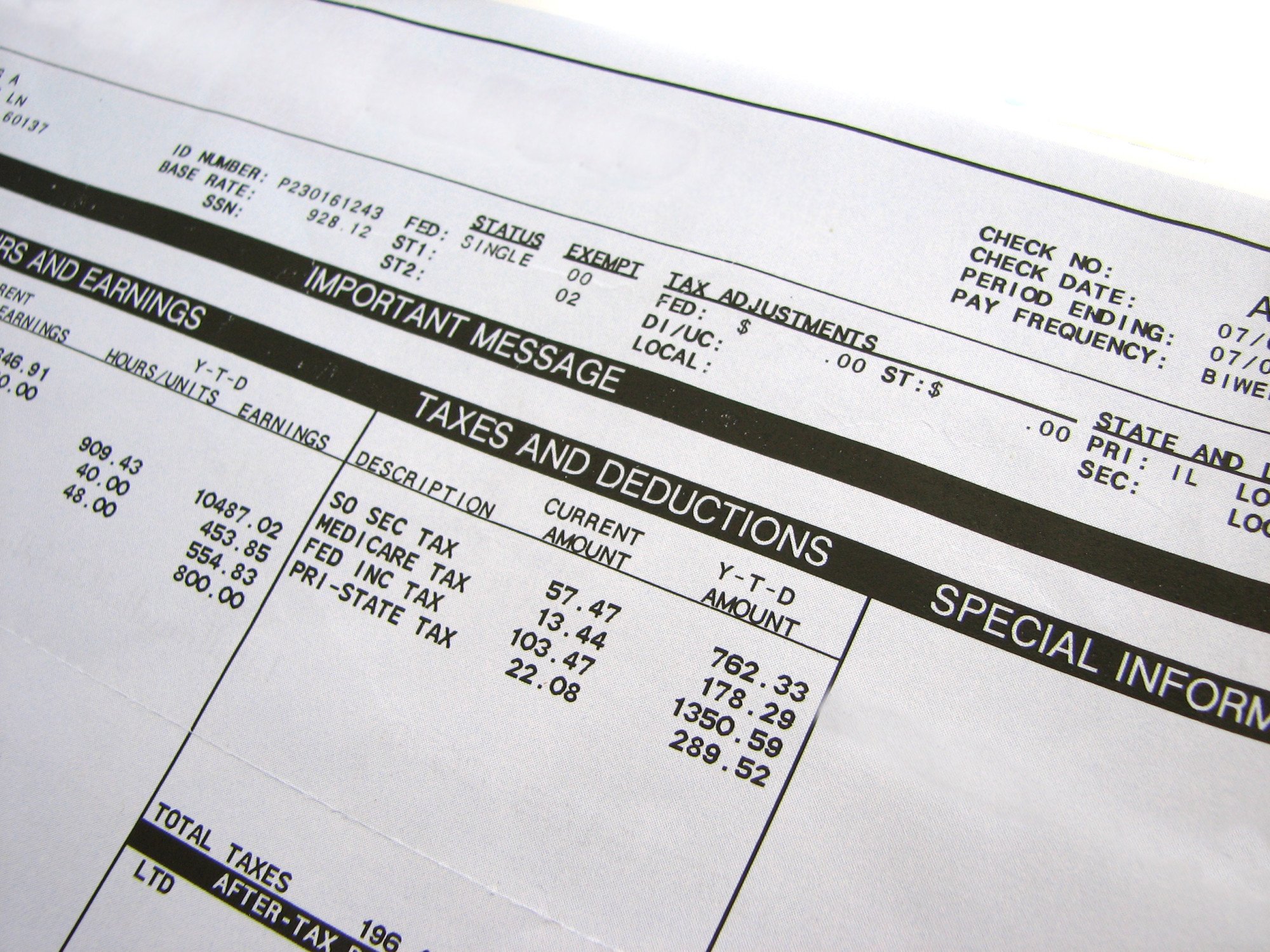

Tax Deductions

The biggest and most confusing group of deductions are the tax-related deductions. These are some of the different kinds of deductions that the government takes off the top of your check.

- Federal taxes

- State taxes

- Federal Insurance Contributions Act (FICA) taxes

You don’t get to choose these deductions. But, the number of dependents you list on your I9 form will affect the amount they take out of your paycheck.

Other Deductions

On top of your tax deductions, you may see other deductions taken out of your check. Some are voluntary, but others are not.

An example of an optional deduction would be health insurance or a retirement savings plan. While deductions like child support or other court-ordered deductions.

Helping You Make “Cents” of Your Paystubs

Once you understand the accounting terms on your stub, it’s easy to make sure that your paycheck amount is correct. Accountants are humans too and errors do happen. Catching a mistake can save you a chunk of change!

If you work about the same number of hours each week, then your checks should end up around the same amount each time. If you notice something unusual on your stub, reach out to HR or accounting to get it corrected ASAP.

We hope you enjoyed reading this article and that you learned a few things about paystubs. If you’re looking for more great articles about businesses and getting paid, check out the rest of our blog today!